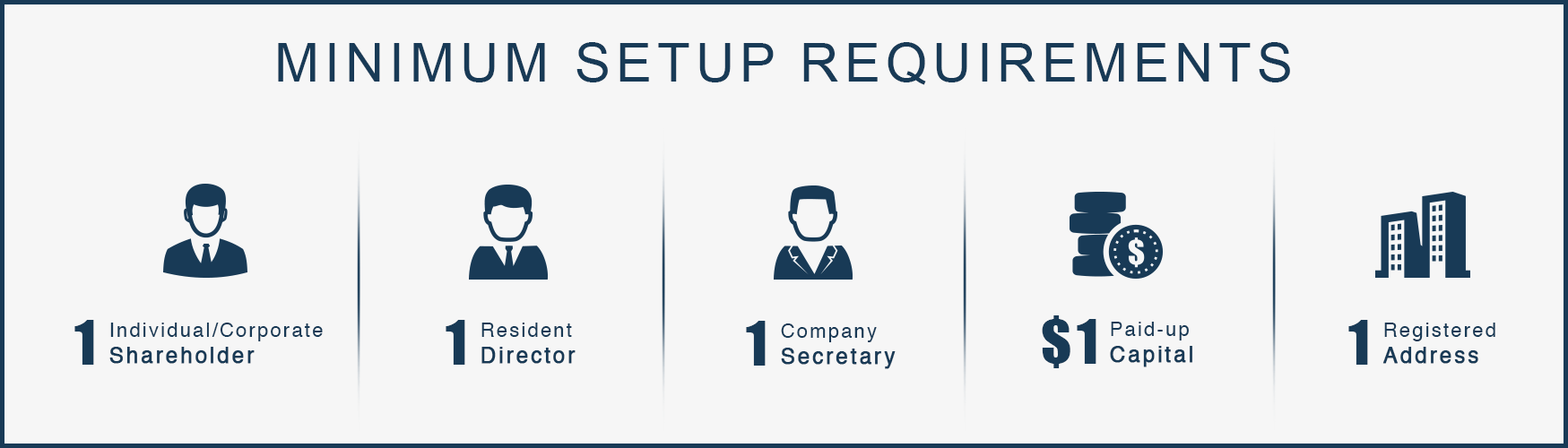

Singapore Company Registration Requirements:

The minimum requirements for settings up a Singapore private limited company are:

Statutory Compliance Requirements:

At least 1 local resident director,

(Guide me: A minimum of one resident director (a resident is defined as a Singapore Citizen, a Singaporean Permanent Resident, or a person who has been issued an Entrepass, Employment Pass, or Dependent Pass) is mandatory. There is no limit on the number of additional local or foreign directors a Singapore Company can appoint. Directors must be at least 18 years of age and must not be bankrupt or convicted for any malpractice in the past. There is no requirement for the directors to also be shareholders, i.e. non-shareholders can be appointed directors.)

At least 1 Shareholder,

(Guide me: A Singapore private limited company can have a minimum of 1 and maximum of 50 shareholders. A director and shareholder can be the same or a different person. The shareholder can be a person or another legal entity such as another company or trust. 100% local or foreign shareholding is allowed. New shares can be issued or existing shares can be transferred to another person anytime after the Singapore company has gone through the incorporation process.)

At least 1 Company Secretary,

(Guide me :As per Section 171 of the Singapore Companies Act, every company must appoint a qualified company secretary within 6 months of its incorporation. It has to be noted that in case of a sole director/shareholder, the same person cannot act as the company secretary. The company secretary must be a natural person who is ordinarily resident in Singapore.)

At least S$1 dollar of Paid-up Capital,

(Guide me: Minimum paid-up capital for registration of a Singapore company is S$1. Paid-up capital (also known as share capital) can be increased anytime after the incorporation of the company. There is no concept of Authorized Capital for Singapore companies.)

A local Singapore address,

(Guide me : In order to register a Singapore company, you must provide a local Singapore address as the registered address of the company. The registered address must be a physical address (can be either a residential or commercial address) and cannot be a P.O. Box.)

Singapore Company Registration Process

The entire Company registration process could be done by designated Professional firms online via the Singapore Registrar of Companies. Therefore incorporating a Singapore company with a professional firm would be timely efficient, and for most cases it take less than 24 hours to incorporate a company in Singapore.

Providing Company Registration Details

Company Name

Choosing a valid Company Name is the first step of incorporating a company in Singapore. The Company name must be approved before incorporation can occur.

Business Activities & Licensing

Provide Brief description of what business activities your company will be engaging with. We will assist you to choose the most relevant business activity from the list of Singapore Standard Industrial Classification (SSIC).

Depending on the company’s business activities, for certain industries you will need to obtain business licenses after the company has incorporated in order to commence business operations. The usual examples of industries will need to acquire business licenses before commencing business operations are financial sectors, restaurants, import/export of goods, educational institutes and travel agencies etc.

Documents to provide

Most Singapore professional firm will provide you with a simple form for you to provide the basic company incorporation information such as Company Name, Business Activities, shareholding structure, director & shareholder’s particulars, Company Registered Address and Company Secretary Particulars.

In the case of Corporate shareholding, you will need to provide the Certificate of Incorporation from the parent company, a resolution for setting up of an Singapore company.

Post-Incorporation Formalities

Certificate of Company Registration confirmation

The Singapore Company Registrar will send an official email notify the company has successfully incorporated. The official email notification will be treated as the official certificate of incorporation in Singapore. However, if you wish to have a hard copy of the certificate of incorporation, you may request to purchase one online through the Singapore Company Registrar at S$50.

Company Business Profile

A Business profile can be downloaded from the Singapore Company Registrar by making an one line request with paying a small fee. The Biz File will contain the following details of the company:

- Company name

- Company registration number / Unique Entity Number (UEN)

- Company’s Former, if any

- Date of Incorporation

- Business activities

- Paidup capital

- Company Registered address

- Shareholders details

- Directors details

- Company Secretary details

Etc ..

The email certification of incorporation and the Business profiles are able to be used for any contractual purpose in Singapore, including opening of Corporate Bank accounts, signing of office leasing contracts as well as subscribing to telephone and utility services etc.

Singapore Company Corporate Bank Account Opening

Once the Company has officially set up, you may proceed with opening of a corporate bank account.Most of the banks in Singapore require the company’s principals to be physically present inSingapore, if you are unable to visit Singapore, you should choose a bank that could collaborate with this issue.

Goods & Services Tax (GST) Registration

If your company’s projected annual revenue will exceed SGD1million, your company would be required to register for GST. Once your company is GST registered, you have to charge additional (current) 7% to your clients on the goods and services you provided. On the other hand, GST registration is not required if your company’s annual turnover is below SGD1 million.

+65 6407 1218

+65 6407 1218