Singapore Single-tier income tax system

Since January 2003 onwards, Singapore has been following a single-tier income tax system. This implies that the stakeholders do not have to pay any tax on the dividends that they receive from a company. Tax that the company pays on its chargeable income is treated as the final tax. This way, the Singapore corporate income tax system removes any obstacle regarding double-taxation. Further, Capital gains tax (CGT) does not apply in Singapore. Areas where CGT can be imposed include, but are not restricted to, gains made on capital transactions, foreign exchange transactions, and fixed asset sale.

Singapore Corporate tax rates and Corporate tax exemptions

Headline corporate tax rate

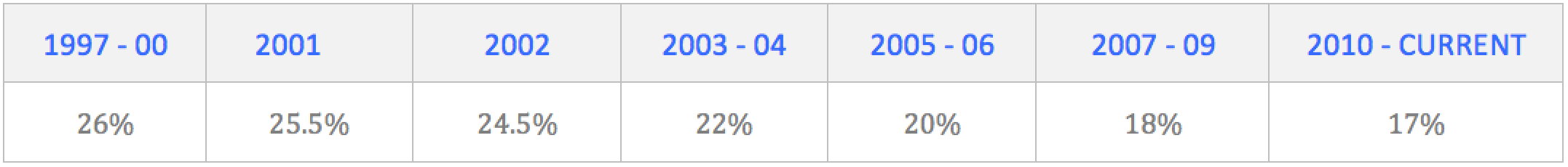

The headline corporate tax is currently charged at a flat rate of 17% in Singapore. It’s corporate income tax rates have been consistently going lower to transform into an attractive investment hub. The table below shows the Singapore’s Corporate income tax rates since 1997 to current.

This headline corporate income tax rate, however, does not truly reflect the effective tax rate. The effective tax rate is usually less than the headline rate due to applicable tax exemptions, incentives and depreciation schedules etc.

General Corporate tax incentives

The general corporate tax incentives available to the resident companies in Singapore are listed below. When applied to the chargeable income of small-size and mid-size companies, these tax incentives dramatically reduces the effective corporate tax incurred.

- No tax on S$100K taxable income

There is no corporate income tax levied on the initial S$100,000 taxable income. This is applicable to the first three years for which the income tax is filed. However, a freshly incorporated company must pass the following criteria

- 8.5% tax levied on taxable income with an upper ceiling of S$300K

Resident companies in Singapore are permitted to avail a part tax rebate which implies that the effective tax rate for up to S$300,000 of yearly earning stands at 8.5%. Beyond the $300,000 ceiling, tax is levied at normal headline rate of 17%.

Effective Corporate income tax rate

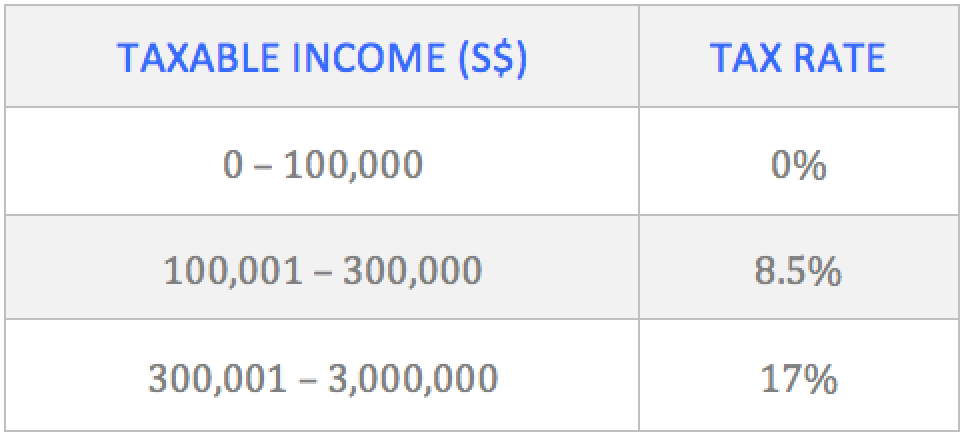

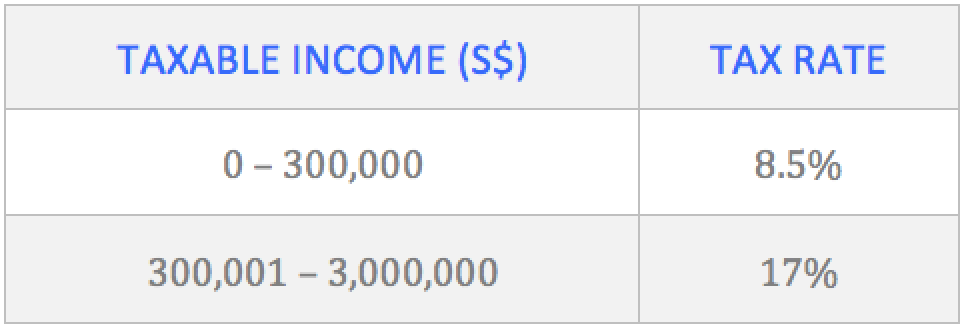

For small-sized and mid-sized companies, the tax incentives can translate into eye-catching tax rates. For instance, a resident company in Singapore with a yearly taxable income of S$3,000,000 will be taxed as mentioned below.

For First Three Years When Income Tax Returns Have Been Filed

After The First Three Years

Tax exemptions for specific industries

General tax exemptions have been enumerated above. Apart from these, there are certain set of tax rebates which are specific to industries or apply for special purposes. The Singapore Income Tax Act mentions many such cases where concessionary tax rates apply.

Corporate Income Tax (CIT) Rebate for YA 2016 & YA 2017 (one-off)

Each resident company in Singapore can avail a corporate income tax incentive according to the 2015 edition of Singapore’s budget. The claim can be made as a one-off 30% tax deduction on corporate tax payable for financial year 2016 and financial year 2017. This deduction is subject to an upper ceiling of S$20,000.

Due Date for filing of Corporate Income tax returns

Since the year 2009, 30th November has been declared as the date for companies to file their income tax returns.The tax returns shall include, but is not restricted to, audited/unaudited accounts, Form C, computed tax. Form C happens to be a declaration whereby a company states its income. Tax computation statement furnishes the adjustments made to the net profit or net loss of a company in the given year so that the chargeable income can be deduced.

The Withholding Tax Law

The withholding tax law, which is not imposed on resident companies (or individuals) of Singapore, is a law that withholds a percentage of the payment made to non-resident companies (or individuals) and pays the same to the Singapore Income Tax Authorities. This part amount is termed as the withholding tax.

Basis period for Corporate income tax

Singapore Corporate income tax is calculated on the basis of the year gone by, also referred to as the preceding year. In other words, the financial year ending in the year just before the year of assessment (YA) is referred to as the basis period for that YA. As an example, in the financial year of 2013, your tax return will be for the year that may have ended anywhere between January 1, 2012 and December 31, 2012.

Net income as against taxable income

Income made by a company implies dividends, premiums, rental royalties, interest, and capital gains on property,among other things.

The Singapore Corporate Income Tax Act states that a corporate tax must be levied on the profit that i) accrues or is derived from Singapore or ii) is received within Singapore from activities conducted outside it and certain exemptions falling within “foreign-sourced income” may apply.

The net profit registered by a company or loss made by it does not solely provide a clear picture of its taxable income. As an instance, each expense incurred by your company cannot be deducted for tax purposes and similarly, all the income made by your company may not be taxed either. Such income can also be treated as nontrade source income and separately taxed.

Guided by the Singapore Income Tax Act, certain types of incomes earned by companies can be made exempt from tax. Such rebates may include, but are certainly not limited to, general tax incentives available to each company, industry-specific exemptions (one that is offered to shipping companies for instance), exemption on income earned through foreign branches, and exemptions on dividends sourced from overseas.

How losses incurred are treated for tax in Singapore

For the purpose of taxation, Singapore resident companies can offset allowable expenses against income earned. The loss can be carried forward for an indefinite period until further notice (this is however subject to certain conditions.) The registered loss must though be deducted in the very first year when there is a statutory income. It is worth noting that the losses can be used only till the time no sizeable alteration occurs in the shareholding. Losses are deducted on the preceding year basis.

Company’s tax residence

Any company can be thought of as a resident company of Singapore if its control and management is exercised within the physical boundary of the country. What is control and management, one may ask? These terms refer to the decision making at policy level; one that involves Board of Directors.

When companies exercise control and manage affairs from outside the boundary of Singapore and hold their board meetings the same way, a company is referred to as a non-resident company. It does not matter if the lower-level decision-making takes place within the country. Till the time the upper hierarchy of management controls operations from outside Singapore, the non-resident status remains. From what has been discussed, it is easy to conclude that the residence of a company can change from one YA to another. If an overseas company has a branch in Singapore, the branch is treated as non-resident because the affairs of the parent company are not managed from within Singapore.

The resident and non-resident companies are taxed the same way and the difference, if any, lies in the bestowal of certain benefits to the resident companies. Such benefits for the resident companies can include:

- Corporate income tax exemption schemes are offered to freshly incorporated companies.

- Under section 13(8), the Income Tax Act, tax rebates can be offered to Singapore resident companies if their dividends are sourced from overseas, if their profits are registered through a foreign branch, and if their service income is sourced from overseas.

- Resident companies can benefit from Avoidance of Double Taxation Agreements (DTA), subject to the tax treaties.

Tax treaties involving Singapore

When a company does business in two countries, both of them can work out a treaty that determines how income earned by the company of one country will be taxed in another. This is called a tax treaty and its primary aim is to help companies avoid double taxation.

Presently, Singapore has tax treaties with nothing less than 50 countries (and counting….). Such treaties are true reflection of the effort Singapore makes to reduce the baggage of double taxation and create a business-friendly environment across borders.

2008 onwards, Singapore has introduced a new policy related to availability of unilateral tax credits to companies in Singapore. Every company in Singapore, according to the policy, will be provided a tax rebate on the income they source from those overseas companies that do not have their countries involved in any tax treaty with Singapore.

+65 6407 1218

+65 6407 1218